By now, you’d be hard pressed to name an industry that hasn’t begun exploring the potential of blockchain technology. Increased transparency, reduced transaction costs, faster settlements, user control over data and true network decentralization — the benefits could revolutionize many industries. With cryptocurrency being the most mainstream application of blockchain technology, it may not come as a surprise that the banking and finance industry seems to be leading the way in adoption.

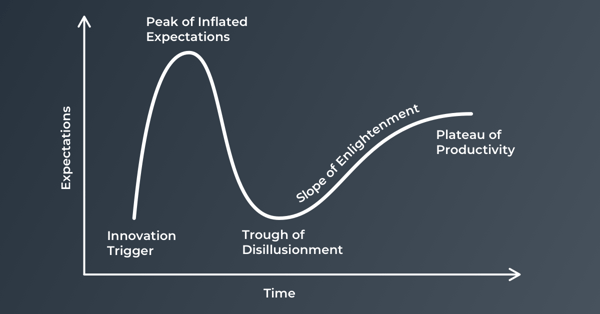

The Gartner Hype Cycle

The Gartner Hype Cycle

As we work our way across Gartner’s hype cycle, leaders from the finance and banking industries could care less about the ICO boom of 2017 (Peak of inflated expectations) or the crypto winter that followed (Trough of disillusionment); they’ve had their heads down working on proofs of concept (Slope of enlightenment) with clients, partners and even competitors in a race to realize the massive ROI of blockchain and distributed ledger technology.

Note: though “blockchain” and “distributed ledger technology” are sometimes used interchangeably and have some overlap, they’re not the same thing, and here’s another good read on that topic.

The financial services sector was one of the first industries to explore the transformative power of blockchain technology. In fact, many saw the emerging technology as a threat and it’s easy to understand why: there’s the potential to fundamentally change the way traditional banks do business. How these institutions interact with each other, their customers and even regulators will be impacted by blockchain technology. While dramatic operational and logistical changes are very rarely universally embraced you can’t argue with data and at the end of the day, the bottom-line is what determines success in the world of banking and finance.

Blockchain applications pertaining to trade finance, customer on-boarding, regulatory reporting and cross-border payments have the potential to save institutions millions of dollars in annual operating costs and from a revenue generation standpoint, crypto-trading services, loyalty programs and securities-lending services are just the tip of the iceberg.

Let’s take a look at the blockchain innovation trail blazers within the world of banking and finance to better understand what they’re working on, who they’re working with, and what technologies they’re leveraging to drive this monumental change.

American Express

Application: Customer Loyalty Program

Technology: Hyperledger Fabric

American Express has developed a blockchain-based loyalty program solution entirely in-house using Hyperledger Fabric. Online retailer Boxed is already on board. With traditional loyalty programs, customers earn points based on the total transaction spend. With Amex’s solution, a retailer can be much more granular with the rewards offered, depending on the purchase channel, applying different rewards to specific items or services purchased, etc.

Ant Financial

Applications: Cross-Border Money Transfers, Charity Tracking

Technology: Ant Blockchain

China's Ant Financial started as Alipay, the payment arm of e-commerce giant Alibaba in 2004, developed a proprietary blockchain platform, on which it’s running several blockchain-based applications. As far back as 2016, Ant Financial started using their blockchain to record transactions and improve accountability of Chinese charities.

Alipay is China’s leading online and mobile payments service provider and in June 2018 launched a blockchain-based money transfer service for people in Hong Kong and the Philippines enabling them to transfer money across borders in seconds.

Bank of England

Application: Real-Time Gross Settlement

Technology: Corda

The Bank of England is exploring how blockchain and distributed ledger technology could be used to revamp the system that underpins British banking and trading in London. They’re seeking to strengthen defense against cyber attacks, prevent data from being stolen or altered, and keep the UK a fintech innovation leader.

BBVA

Application: Loans and Bonds Issuance

Technology: Corda, Ethereum, Hyperledger Fabric

Banco Bilbao Vazcaya Argentaria (BVA), Spain’s second-largest bank, has been positioning itself as a pioneer in adopting blockchain technology, announcing several “firsts” over the last few months: in December 2018, BVA, announced the first blockchain-based acquisition term loan, a $170M loan for Porsche Holding, the largest car distributor in Europe and a subsidiary of Volkswagen AG. This followed a $150M blockchain-based syndicated loan for Red Eléctrica Corporación, Spain’s electrical grid operator — the first syndicated loan on blockchain. In February of this year, BBVA issued “the first blockchain-supported structured green bond for MAPFRE”.

“This transaction is all about putting blockchain technology into meaningful practice in the interactions with our clients,” said Head of BBVA CIP in German Frank Hoefnagels of the pilot with Porsche Holding. “Our aim is to improve clients’ experience by simplifying processes and enhancing the speed of execution.”

Interested in getting blockchain stats delivered to you?

You might be interested in Dispatch, a tool we're working on that makes it super easy and fast to create blockchain-based notifications and automations.

BNP Paribas, HSBC

Application: Letters of Credit

Technology: Corda, Ethereum, Hyperledger Fabric

To expedite trade flows, French bank BNP Paribas is attempting to move letters of credit from paper to a secure distributed ledger. In November 2018 Paribas worked with HSBC Singapore to complete Singapore’s first fully digitized letter-of-credit transaction between Rio Tinto, one of the world’s largest metals and mining corporations, and their customer Cargill. BNP issued a letter of credit over the blockchain on behalf of Cargill to HSBC Singapore, who acted on behalf of Rio Tinto.

Letters of credit, commonly used in international trade and domestically for construction projects, seem like an ideal application of blockchain: banks act as “disinterested” third parties that release funds only after certain conditions are met — for example, goods have been received and match the customer’s expectation of what the seller promised.

According to BNP’s press release, using Voltron’s trade finance solution on top of R3’s Corda with Bolero’s electronic bill of lading system, the letter-of-credit issuance was completed in less than two hours, versus 1-2 days for the traditional paper-based process.

Broadridge Financial

Application: Investor Proxy Voting

Technology: DAML, Quorum, Hyperledger Fabric

Broadridge Financial (an ADP spinoff) provides investor communications solutions for broker-dealers, banks, mutual funds and corporate issuers, controlling 80% of the U.S. proxy-voting and shareholder-communications business. Traditionally, in order to vote on corporate resolutions stockholders have to go through the custodial banks that hold their shares. Broadridge is working on a blockchain-based proxy-voting service to make it easier for investors to cast their votes and see the confirmation and vote count in real time instead of having to wait weeks for a process that requires paperwork by multiple middlemen.

In January Broadridge and ICJ Inc. (a joint venture of Broadridge and the Tokyo Stock Exchange) completed their first proof of concept of a blockchain-based proxy vote in Japan, using JP Morgan’s Quorum. Last year Broadridge completed a pilot of its blockchain-based software to enable investors to vote at Banco Santander’s annual shareholder meeting.

CitiGroup + Barclays

Application: DApp Store for Financial Institutions

Technology: Hyperledger Fabric, IBM Blockchain Platform

Last summer Citigroup and Barclays joined nine financial institutions for the LedgerConnect proof of concept, a project headed by IBM and CLS, a financial infrastructure provider whose global foreign-exchange network settles $5 trillion payments a day for 24,000 clients.

LedgerConnect is essentially an app store that provides banks access to services for know your customer (KYC) checks, collateral management, derivatives post-trade processing and sanctions screening, operating on a private permissioned network based on the IBM Blockchain Platform and Hyperledger Fabric.

The idea is that sharing services on a shared and highly secured network save banks time and money so banks don’t need to create and operate their own unique digital ledger infrastructure. We haven’t seen any updates on this since a Bloomberg article last July stating that the test was concluding in a few weeks.

Earlier this year, Barclays hosted a hackathon at their London fintech hub with London-based startup Clearmatics to explore interoperability between enterprise blockchain platforms, with judges from UBS, HSBC and Santander. Both Citi and Barclays have invested in blockchain startups.

The Depository Trust & Clearing Corporation

Application: Credit Derivatives Tracking

Technology: Axoni, Axcore

The Depository Trust & Clearing Corporation (DTCC) provides custody, clearing and settlement to the financial markets, performing securities exchanges on behalf of buyers and sellers for $1.85 quadrillion in transactions per year (you read that right, Quadrillion). The DTCC is planning to move its $10 trillion-a-year credits derivatives tracking operation to a customized blockchain.

Testing of the new blockchain-powered version of their Trade Information Warehouse (TIW) platform began in November 2018. If the new system, scheduled to launch by the end of 2019, is successful, it could eliminate massive record redundancies and show that a centralized clearing house still has a place in a decentralized world.

ING + Credit Suisse

Applications: Securities Lending, Agricultural Commodities Trading

Technology: Corda, Hyperledger Fabric, Hyperledger Indy, Quorum

ING has launched eight pilots since the creation of its dedicated blockchain team in 2016. In March 2018, ING and Credit Suisse completed the first live securities lending transaction on a blockchain (R3’s Corda) using a collateral lending application by fintech firm HQLAx, having started the project in April 2017. Traditionally, settlement of a security lending trade can take days to settle, during which the liquidity of the trades is postponed. Using HQLAx’s collateral lending application, the process takes less time, the collateral is available immediately, and all parties can monitor the transaction in real time.

ING completed the first blockchain trade of agricultural commodities in January 2018 using its Easy Trading Connect platform. The bank has also invested in several blockchain ventures, including Komgo — formed by 15 banks including ING, BNP Paribas, Citi, Rabobank, Shell and Société Génerale — working with ConsenSys to increase transparency, reduce operational costs and lower risks for the commodity trade finance industry using the Ethereum blockchain.

J.P. Morgan Chase

Applications: Enterprise Spin-Off of Ethereum Blockchain, Bank-Backed Digital Token

Technology: Quorum, Ethereum

While J.P. Morgan Chase recently announced JPM Coin for real-time institution-to-institution payments, their larger contribution to the blockchain space is without a doubt Quorum, a permissioned version of the Ethereum blockchain built specifically for enterprises looking to add privacy to the other benefits offered by blockchain (increased back-office efficiencies, transparency). Just last week, Microsoft announced that Quorum will be the first blockchain platform available as a managed service on its Azure cloud service.

Quorum powers J.P. Morgan’s Interbank Information Network (IIN) as well as Microsoft’s Xbox blockchain-based royalty payment process. IIN launched in 2017, enabling its 220 member banks to exchange payment information in real-time where traditionally if payment instructions were missing or incorrect, banks needed additional compliance checks, sending questions through the payment chain until reaching the person with the correct person who then sent the information back after correcting it.

Nasdaq

Applications: Fraud Detection for Crypto Exchanges, Electronic Shareholder Voting, Business Payment Processing, Mutual Fund Management

Technology: Corda, Hyperledger Fabric, Symbiont, Chain Core

Decentralized exchanges could someday render traditional centralized exchanges obsolete, and Nasdaq is embracing blockchain to stay ahead. They’ve developed proprietary trading, clearing and market surveillance technology that scans for fraudulent transaction patterns. Use of this technology can help make institutions and long-time traders more comfortable with using cryptocurrency exchanges. Nasdaq has licensed their market-surveillance software to seven such exchanges.

They’ve also developed a blockchain-based electronic voting platform for shareholders to vote on new acquisitions, new share issuances and board elections -- first developed for Nasdaq’s Estonia market and licensed to South Africa’s central securities depository Strate in November 2017.

Seeing an opportunity to revamp Sweden’s massive mutual fund market, Nasdaq and Nordic bank SEB developed a prototype for issuance and settlement of mutual fund shares based on blockchain technology, to replace the inefficient paper-driven process Eight mutual-fund-related companies have joined the project, each committing up to two full-time employees to explore feasibility.

In 2017 Nasdaq and Citi partnered to provide an institutional banking solution enabling straight through payment processing and automatic reconciliation using a distributed ledger to record and transmit payment instructions. This solution leverages Chain Core, the blockchain platform by Chain, a company both Nasdaq and Citi invested in.

Nasdaq Ventures led a $20M Series B funding round for Symbiont, a blockchain platform for financial institutions. Citi also participated in the round.

Northern Trust

Application: Private Equity Auditing

Technology: Ethereum, Hyperledger Fabric

Northern Trust has launched an “instant audit” initiative with PwC and begun using Hyperledger Fabric to handle the administration of private equity fund events, including initial sales and liquidations of fund investments. Northern Trust is also helping hedge funds track their crypto investments and is working with the Australian Securities Exchange on a blockchain-based equities clearing, settlement and custody platform. Last year, it helped the World Bank execute a $79 million bond issue via the Ethereum blockchain.

PNC

Application: International Payments, Health Insurance Payment Processing

Technology: Corda, DAML, Hyperledger Fabric, Ripple xCurrent

The bank is using Ripple’s xCurrent blockchain-based software to speed up the way its U.S. business clients get paid invoices by overseas buyers. PNC is the only bank involved with IBM’s Health Utility Network, which is attempting to speed up claims and payment processing and facilitate secure patient medical data exchange to benefit consumers, health providers and insurance companies.

Royal Bank of Scotland

Application: Real Estate Purchasing, International Payments

Technology: Corda

In February this year, RBS and Barclays were among 40 companies to participate in a global Alpha trial of Instant Property Network, a startup using R3’s Corda blockchain to simplify real estate purchasing. IPN claims they can cut the time it takes to buy a house from months to weeks and could save financial firms $160B annually.

Santander

Application: Investor Voting, International Payments

Technology: Hyperledger Fabric, Ripple xCurrent

Banco Santander invested in Ripple in 2015 and announced several blockchain-based solutions last year. As mentioned above, Santander used Broadridge Financial’s blockchain-based proxy-voting service at its annual shareholder meeting, announcing they were the first company to use blockchain technology for investor voting. In April 2018, they launched Santander One Pay FX, a blockchain-based international payments service, enabling international money transfers in less than a day. The service is powered by Ripple’s xCurrent. Santander is an investor in Ripple.

Signature Bank

Application: Real-Time Commercial Payments

Technology: Private Ethereum-based Blockchain

New York-based Signature Bank launched Signet Platform on New Year’s Day. The blockchain-based digital payments platform enables the bank’s commercial clients to make payments online and in real-time, eliminating the need for third parties. Clients can pay each other instantaneously at their convenience independent of bank operating hours, with no transaction fees.

American PowerNet, a power supply company, is using Signet to make real-time payments to renewable energy providers. American PowerNet is now able to settle with power generators as schedules are confirmed (daily), replacing the traditional 30-day payment structure.

Visa

Application: Cross-Border B2B Payments

Technology: Hyperledger Fabric

Visa is gearing up to launch B2B Connect, a blockchain-based cross-border platform for business-to-business payments. According to Visa’s latest earnings call, they’ve already signed up distribution partners for B2B Connect, including FIS and Bottomline Technologies. With this launch, Visa is positioned to take a chunk out of the cross-border B2B transaction market, which Juniper Research forecasts will exceed $218 trillion by 2022.

As evidenced by these case studies, the banking and finance industry sees enormous opportunity to modernize and improve the experience, security, speed and efficiency of money exchange. Established industry giants are partnering up and working with, as well as investing in startups to explore the possibilities. Of course, there have also been unsuccessful proofs of concept. It’s clear we’re still in the early stages of blockchain adoption. Challenges remain, particularly around governance, scalability and security.

Beyond the financial industries’ obsession with quant-driven, pragmatic decision making, why are they pulling ahead in the race to bring blockchain adoption mainstream? Consortium engagement is higher than ever before. According to Deloitte’s 2018 Global Blockchain Survey, 45% of respondents from the financial services industry indicated that they planned to join a consortium in the coming year, another 29% indicated they were already actively involved in an industry consortium.

R3, the global financial services consortium behind the Corda blockchain, has over 300 members, and a major development platform in London. The Linux Foundation’s Hyperledger consortium passed 250 members last year. Consortium benefits including shared costs, the ability to create unified industry standards and industry-wide scale have organizations who traditionally keep resources and user data close to the chest, more willing than ever to collaborate in an effort to drive innovation.

In addition to cost savings and efficiencies for institutions, consumers are becoming more savvy and may eventually prefer doing business with companies that operate with the transparency and control over one’s data provided by blockchain. Blockchain technology is driving transformational change within the financial services industry. These proofs of concept and case studies will become proven solutions delivering benefits sought by customers and business partners alike. Those institutions who embrace the challenges and opportunities will be best positioned for growth in the years that come.

You may be interested in Dispatch, a tool we're working on that makes it super easy and fast to create blockchain-based notifications and automations.