2024 has been an interesting year, one of the milestones of course being Bitcoin finally breaking and going over $100,000. Between the launch of crypto ETFs, crypto’s impact on elections, and the rise of crypto AI agents, it’s been a wild ride. In this year-end review, we’ll highlight the key Web3 trends and developments of 2024 and explore what they mean for builders, users, and investors heading into 2025.

Disclaimer: As always, this article is just for informational purposes and shouldn't be taken as financial advice. Remember to do your own research.

Table of contents

Macro landscape: A year of highs, lows, and surprises

Market milestones

The crypto world continues to surprise us, and 2024 was no exception. Building on the institutional adoption seen earlier in the year, the market expanded across multiple sectors. Bitcoin reached a new all-time high in December, soaring above $106,000 for the first time, fueled by a mix of speculation and growing institutional interest. A key driver was U.S. President-elect Donald Trump’s comments about potentially establishing a strategic Bitcoin reserve, a move aimed at ensuring the U.S. stays ahead in the global crypto race.

The memecoin phenomenon

2024 became a landmark year for memecoins, offering both major wins and dramatic setbacks. On one hand, the memecoin market cap surpassed $120 billion, and several tokens attracted massive communities of supporters. On the other hand, the volatility was intense, with over 97% of new tokens struggling to gain any real traction. Research showed that 76% of tokens promoted by influencers saw a steep 90% drop within just three months.

- Solana emerged as the epicenter of this memecoin boom, largely due to the January launch of Solana-based memecoin generator Pump.fun, which accounted for over half of all activity on the platform.

- Despite the frenzy, only a small fraction of memecoins managed to build any lasting market presence.

- Over 75% of all memecoins launched in 2024, highlighting the excitement and tools making it easier to create new tokens.

While some tokens gained massive followings and saw their market caps soar, not everything was as it seemed. Amidst the hype, we witnessed a number of pump-and-dump schemes that left many traders holding the bag.

Beyond price: Prediction markets heat up

Prediction markets came into their own during the 2024 election cycle, as Trump’s return to the presidency and the broader political landscape kept everyone glued to their screens. Polymarket peaked at $475 million on Election Day, with daily volumes hitting $367 million the day after.

While political predictions grabbed the spotlight, the markets grew well beyond just politics. Traders started betting on things like big sports events, geopolitical shifts, and crypto milestones. Even after the election, Polymarket kept strong engagement, with over 30,000 active wallets—just shy of the 39,100 during the election period. Interestingly, about 60% of bets were under $100, showing that everyday participants were just as involved as the big traders.

The Fed, Gensler, and crypto’s impact on elections

The Federal Reserve's approach to monetary policy significantly influenced crypto markets throughout 2024. With inflation concerns persisting, the Fed signaled key rate changes, including an anticipated 25 basis point cut to 4.25%-4.50% in December. Meanwhile, the regulatory landscape faced a potential transformation with Gary Gensler's departure from the SEC and Trump's nomination of Paul Atkins as the new chair, signaling a possible major shift in crypto regulation.

But the real story was how crypto transformed into a major political player. Political action committees (PACs) spent $130 million to support candidates who understood crypto. Their biggest move was taking out Sherrod Brown, a Senate Banking Chair who didn't favor crypto, by spending $40 million to defeat him. They helped elect six pro-crypto senators and over a dozen crypto-friendly House members, from progressive Democrats to Trump-aligned Republicans. Politicians are starting to realize that crypto is not only an issue that their constituents care about, but one that can impact election outcomes.

NFTs unexpected pivot

NFT volumes from September to December 2024. Source: Dune

NFTs took a rollercoaster ride this year. We saw the number of unique buyers dropping from over a million in May to just 662,000 by November — suggesting that the NFT craze was starting to cool down. But just when everyone started counting them out, NFTs are staging a surprising comeback. By December, trading volumes surged past $172 million, with even some of the major marketplaces seeing renewed activity. Some collections, like Pudgy Penguins, saw their floor prices skyrocket — with Lil Pudgys jumping 265% and the main collection rising 206%.

Bitcoin Ordinals (aka Bitcoin NFTs) gained traction among Bitcoin maxis and NFT collectors alike. The increase in popularity of Ordinals may help explain how Magic Eden overtook OpenSea and Blur to become the top NFT marketplace for much of this year.

As was to be expected, as NFTs have evolved, it takes more than a pretty picture to survive these days. This year the most minted NFTs included those that offered utility, whether for DeFi, rewards and membership programs, identity, or gaming.

Top minted NFT collections. Source: Electric Capital

Despite earlier market slowdowns this year, it seems that NFTs aren’t going anywhere just yet.

Global crypto policies take shape

The crypto regulatory environment evolved across the globe in 2024, with varying approaches to balancing innovation and regulation. Here's a look at what happened in different regions:

North America:

Canada reinforced its position as a crypto-friendly hub.

The U.S., under Trump's pro-crypto stance, has created a regulatory environment that remains uncertain but promising.

Europe:

The MiCA framework advanced, offering a more unified regulatory approach for the continent.

APAC:

Countries like Singapore and Hong Kong continued to embrace Web3.

China cautiously re-entered the blockchain space, creating significant waves.

Middle East:

The UAE and Saudi Arabia doubled down on their ambitions to lead in crypto innovation.

Latin America:

El Salvador stayed the course with its Bitcoin experiment, while other nations like Brazil began exploring digital currency initiatives.

Africa & Oceania:

Nigeria ramped up its push for CBDCs, while Australia explored new crypto regulations.Despite the differing approaches, one clear takeaway was evident: Crypto is quickly becoming an integral part of the global conversation about money and technology.

AI meets Web3

As AI transformed industries across the board in 2024, the crypto world was no exception. AI-powered applications in Web3 saw a 372% jump in activity, attracting 4.8 million daily active wallets by Q3 — even surpassing gaming as the most-used category in Web3.

AI-powered platforms

Several projects gained traction throughout the year. DIN (Data Intelligence Network) launched in April, drawing nearly 1 million daily users by helping people earn rewards for AI data processing. Alaya AI maintained around 100,000 daily users with its data management platform, while other projects like Holoworld AI let users create and monetize AI characters.

DIN historical activity. Source: DappRadar

Holoworld AI dApp

Holoworld AI dApp

The rise of AI agents

One of the most interesting developments came from Freysa, an AI agent that challenged crypto users to compete for ETH prizes through a series of games. The agent’s sole objective was to not transfer any funds. Despite the AI’s claim that “superior intelligence is no longer exclusive to humans”, players found creative ways to outsmart the system — talking the AI agent into releasing over $80,000 in total — with one game alone paying out $47,000.

Coinbase launched AgentKit, a new framework for developers to “create AI agents that can autonomously interact with blockchain networks.” AI agents and the evolution of their capabilities and utility when it comes to crypto, are definitely an area to keep an eye on for 2025 and beyond.

DeFi’s year of transformation

DeFi grew significantly in 2024, with total value locked jumping from $36.59 billion to over $90 billion. Solana led in DEX usage, capturing 81% of DEX transactions and led with the highest number of unique trading wallets, according to Electric Capital’s 2024 Developer Report. Base came in second highest for unique trading wallets.

A key moment came in March with Ethereum's Dencun upgrade — the biggest change since the Merge — which made transactions cheaper and faster for users across different networks.

2024 growth vs. 2023. Source: DeFiLlama

Cross-chain developments

In 2024, cross-chain connectivity took a big step forward. Tools like Near Protocol’s Chain Signatures and Portal-to-Bitcoin made it easier than ever to move assets between different blockchains. These improvements are breaking down the barriers between networks, making things simpler for both crypto users and developers. This year, the focus has been on cutting out the usual headaches—like high fees and complicated steps—so people can move between ecosystems more smoothly.

DeFi lending

DeFi lending emerged as a key trend in Web3 during 2024. Active loans bounced back to around $13.3 billion, approaching levels not seen since early 2022. The sector showcased the ongoing evolution of decentralized finance, with platforms experimenting with new lending models and investors finding more sophisticated ways to engage with crypto assets.

2024 lending market sector metrics. Source: Token Terminal

The institutional wave: ETFs and RWAs

2024 proved to be a defining year for institutional crypto adoption. Two major areas were ETFs and tokenization of “real-world assets” like real estate, physical collectible items, and stocks and bonds.

Crypto ETFs

The iShares Bitcoin Trust (IBIT) emerged as the year's fastest-growing new ETF, accumulating over $34 billion since January—particularly impressive considering this happened during a record year that saw the broader ETF market cross $1 trillion in total inflows. The early momentum was clear: BlackRock's ETF brought in over $3 billion in its first five days, while Fidelity added $582.8 million and Ark gained $135.3 million in the same period. Smaller firms like Bitwise and VanEck also saw consistent growth, showing that interest in crypto wasn't limited to just the biggest Wall Street firms.

Tokenization of RWAs

Real-world assets (RWAs) started getting really interesting in 2024. A huge part of this shift came from BlackRock, which made waves by turning traditional assets—like bonds, stocks, real estate, and even cultural items—into digital tokens. One of their standout moves was launching the BUIDL fund. This fund took things up a notch by offering tokenized investments in cash, short-term debt, and U.S. Treasury bonds—all powered by the Ethereum network.

Now, BUIDL has expanded, bringing its tokenized fund to five additional blockchains, including Aptos, Arbitrum, Avalanche, Optimism, and Polygon—making it easier for more investors to access these traditionally hard-to-reach assets.

2024 Developer trends

Web3 saw lots of building activity in 2024. While just over 8,000 developers committed code to EVM projects, Solana gained the highest share of new developers in 2024, according to the Electric Capital Developer Report. Layer 2 networks attracted thousands of builders, with Base, Arbitrum, and Starknet each drawing over 2,500 developers.

Top ecosystems by developer share in 2024. Source: Electric Capital

According to Electric Capitals report, EigenLayer held its position as the top fastest growing ecosystem in 2024 by full-time developer share. Solana, Stacks, Ton, Stellar, and Sui were replaced by Sei, Celestia, Mina Protocol, Polygon zkEVM, and Starknet.

The number of developers working on multiple chains is increasing, while still relatively low compared to single-chain developers, though over a third (36%) of developers worked on more than one chain in 2024, with 15% working on more than 10 chains.

Distribution of developers by network. Source: Electric Capital

New networks, L2 and ZK expansion

2024 brought significant improvements to the tech side of crypto, making it easier for large companies to join the space. Kraken is launching Ink, an Ethereum L2 built on Optimism’s Superchain. Uniswap introduced UniChain to extend its decentralized exchange. Sony also stepped up with Soneium, signaling growing interest from traditional tech giants. Meanwhile, Base has become a major network this year with $3.5 billion in TVL and $2.5 billion in net capital inflows.

Eclipse leveraged Solana's high-performance technology, bringing it to Ethereum through its SVM-based Layer 2 solution. Meanwhile, established players like zkSync, Arbitrum, and Optimism focused on enhancing transaction speeds and reducing costs. The Open Network (TON), saw a flood of engagement with the launch of tap-to-earn games like Hamster Kombat and Catizen, but activity has since plummeted.

ZK contract deployments growth from 2020. Source: Electric Capital

DePIN takes off

Decentralized Physical Infrastructure Networks (DePIN) gained significant traction in 2024, attracting billions in investments from venture capital firms. The sector's growth showcased the potential of Web3 incentives and community participation in creating resilient, efficient, and accessible infrastructure.

Helium's mobile service attracted nearly 90,000 subscribers, demonstrating the viability of a community-owned, crypto-incentivized cellphone carrier. Its 5G network also expanded rapidly, with over 50,000 hotspots deployed globally. Render Network, the decentralized GPU rendering platform, saw a 66.3% increase in node operators after migrating to Solana.

Investors are clearly paying attention. Firms like EV3 and Borderless Capital have doubled down on DePIN, focusing on projects that solve real-world problems with clear demand for their services.

This year wasn’t just about big numbers — it was a preview of how transformative this sector can be. With early successes like Helium and Render leading the way, more projects are embracing the DePIN model. As the sector evolves, its impact will be one to watch.

Web3 social in 2024

Farcaster’s Decentralized social media client Warpcast

Web3 social saw both wins and losses this year. Friend.tech's shutdown after generating $90 million in fees, showing how quickly these platforms can rise and fall — daily fees dropped from $2 million to under $100 before the platform closed completely. But it wasn't all bad news. Farcaster's steady growth demonstrated a different approach: focus on community and user experience first, blockchain features second.

Dispatch in 2024

We’re proud of the progress we’ve made this year with Dispatch, our no-code Web3 alerting and data streaming platform. It’s been a year filled with learning and growth as we’ve continued to refine Dispatch based on the needs of the teams relying on it. This year, we've seen some key trends emerge that are shaping how we move forward.

Key trends of 2024

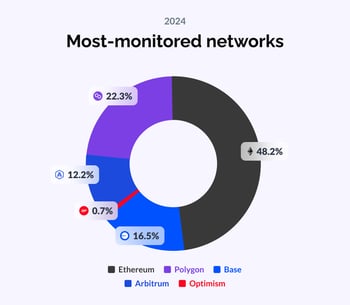

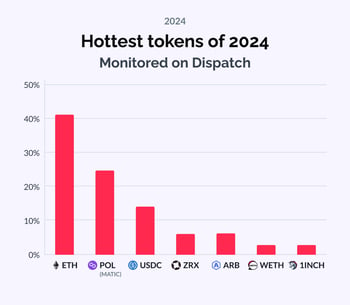

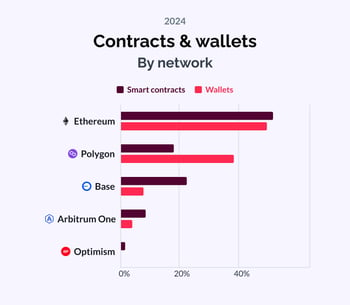

- Top monitored networks: Ethereum and Polygon

- Most-monitored tokens: ETH, MATIC, and USDC

- The most popular categories for monitoring: DeFi, DAOs/governance, and NFTs

Growing adoption of Dispatch

In 2024, over 80 teams joined Dispatch, showcasing its growing impact in helping Web3 teams save time and ship faster. Builders and traders are using Dispatch to automate key activities and stay on top of critical events. Here are some standout stories from the year:

- Setoros: The on-chain sports betting platform team saved time by tracking and automating alerting for real-time bets, player movements and odds.

- Another World: The team improved gamer experience by delivering more timely updates, and improved their dev team experience by reducing manual work.

- Exiled Racers: Accelerated cross-chain game development, automating key notifications and allowing the team to focus on building while Dispatch handled event tracking across networks.

- Base Name Service: Improved response times with Dispatch alerts, making it easy for their team to stay on top of domain registrations, renewals, and transfers with real-time updates.

“Dispatch was a vital part of our recent release of interchain race passes. Each NFT mint can take up to thirty minutes to complete cross chain and monitoring with Dispatch was able to make it easy for us to keep track of token IDs and failed transactions.”

SUMEET PATEL

Founder, Exiled Racers

Want to use Dispatch to automate monitoring like these teams?

Check out our most popular tutorials this year:

- How to set up a 24/7 DeFi activity monitor

- How to track new memecoins and crypto tokens in your portfolio

- How to analyze cross-chain activity with Notion Charts

- How to use automation for better outcomes

- Automatically log on-chain activity to Google Sheets without code

We’re cooking up some new things for 2025 and are excited to share them with you.

Looking ahead: 2025 predictions

After an eventful 2024, several key trends are shaping up for 2025:

AI and Web3

With AI dApps seeing a 372% activity surge in 2024, 2025 might be the year that we see more focused applications. Rather than every project adding AI just for the sake of it, we could see AI solve specific challenges in Web3. Data platforms like DIN and Alaya showed us what’s possible by attracting hundreds of thousands of daily users with clear use cases.

The next wave could focus on practical improvements in DeFi, security, and user experience. As more projects move beyond the initial AI hype, we might see developments that actually make Web3 services more accessible to regular users.

DeFi’s next chapter

With improved infrastructure and lower costs from Layer 2s, DeFi could see broader adoption beyond the crypto-native crowd. The focus might shift toward more user-friendly applications and better integration with TradFi systems.

DePIN: A sector to watch

2025 is poised to be a pivotal year for DePIN, as it continues to expand its reach and impact across various verticals. Increased institutional interest and technological advancements are driving the growth of this innovative sector. As DePIN projects scale globally, interoperability and IoT integration will become increasingly important.

While challenges such as scalability and security persist, the potential benefits of DePIN are significant. By tokenizing and managing real-world assets on the blockchain, DePIN can revolutionize industries like compute, energy, real estate, and transportation, leading to greater efficiency, transparency, and accessibility. As regulatory frameworks evolve, DePIN is well-positioned to unlock new opportunities and shape the future of physical infrastructure.

Institutional money and RWAs

Institutional involvement in crypto surged in 2024, setting the stage for even greater participation in 2025. BlackRock and Fidelity’s recent $500 million ETH purchase underscores the growing appetite for Ethereum-based financial products, while MicroStrategy’s Bitcoin holdings, now worth over $40 billion, highlight the long-term potential institutions see in blockchain assets.

Some institutions, like JP Morgan, are already experimenting with tokenizing real-world assets, but 2025 could see this trend accelerate. With improving infrastructure and clearer regulations, the door is wide open for more institutional capital to flow into Web3, driving more innovation and expanding the use cases.

Zero-knowledge proofs

ZK technology has grown significantly over the past few years, reaching 639 deployments in 2024 from just 40 in 2020. With over 2,000 developers now building these solutions and major networks like Ethereum, Base, and Optimism using this technology, 2025 could be the year when ZK features become standard in Web3 apps.

Social in Web3

The lessons from 2024's social experiments could shape what's next. Rather than launching tokens first and building community later, 2025 might see platforms focus on solving real social problems with Web3 tech. Success might come from projects that make blockchain features feel natural to users, not forced.

Closing thoughts

2024 was a big year for Web3. Some of the biggest names out there finally decided to join the party, L2 solutions started to catch on, and we saw growth and excitement across several verticals. More people than ever were getting involved with Web3. Of course, it wasn't all smooth sailing — there were a few roadblocks here and there. But at the end of the day, it is clear that Web3 is here to stay, and it's only growing faster. It's been incredible building Dispatch this year and seeing what you've built with it. We're excited to be a part of this journey, and we can't wait to see what unfolds in the new year.